Non-EU biotech companies running clinical trials in Europe —particularly in early stages of drug development— may need to find a suitable European Contract Development and Manufacturing Organization (CDMO) to produce and test small batches of vials requiring sterile fill and finish procedures.

However, finding a flexible EU CDMO capable of fabricating small batches of new, highly specialized compounds in a short period of time, as well as providing high-quality aseptic fill-finish services for injectable drugs may not be that easy.

In this article we will discuss the challenges of small-batch manufacturing and sterile fill-finish for injectable medicines to be used in early phase clinical trials. We will also facilitate access to highly recommended European CDMOs with these specific capabilities in the EU.

Why would non-EU biotech companies choose to manufacture their drug products in Europe?

The first question to be addressed is why would a non-European biotech need to produce its experimental medicines in Europe.

Well, in most cases non-EU biopharmaceutical firms will start manufacturing their drug products in their countries of origin, where they are located (e.g. U.S. or China).

Of course, manufacturing your drug in the country where you are headquartered is a natural option for practical reasons, considering also that biotechs will commonly execute their initial phase 1 clinical studies in their own nations.

Nevertheless, when emerging biotechs have to conduct clinical trials in Europe —as they extend their development programs and launch multinational clinical studies—, assembling the drug product [i.e. investigational medicinal product (IMP)] outside of the EU raises a number of additional difficulties.

The main drawback of using an IMP produced in a non-EU country —to carry out a trial in the EU— is the need of a tedious import process, which implies extra complexities (e.g. more paperwork, extra procedures and costs).

Essentially, if you manufacture your IMP outside of the EU, you will have to demonstrate to European regulatory authorities that your drug product complies with GMP at least equivalent to the GMP expected in Europe.

EU regulatory authorities in charge of evaluating clinical trial applications will take the quality of a drug very seriously, raising detailed objections on the Investigational Medicinal Product Dossier (IMPD) if the chemistry, manufacturing, and control (CMC) aspects of the IMP are not aligned with European standards.

Showing that a drug product has been well made outside of the EU, will require onsite audits at the Contract Manufacturing Organization (CMO) where the product was developed, as well as the issuance of a Qualified Person (QP) Declaration, among other red tape.

Furthermore, depending on the type of product you have, intercontinental shipments may add challenges to the process in terms of logistics (e.g. sending large amounts of frozen vials and customs clearance, after having obtained an import authorization).

In addition, once the drug has arrived in Europe, it may need to undergo quality retesting before the batch can be finally released for use in the clinical study.

In contrast, making the drug product in a European member state can be considered advantageous, as local manufacturing completely eliminates the import efforts, while streamlining final testing and batch release.

Therefore, producing an IMP in Europe to conduct a trial in European countries makes sense, particularly if you are going to execute more than one clinical study in the EU in the future.

After discussing the reasons supporting the production of a drug product within the European Union, let’s now focus on the specific challenges faced by biotech companies that need to make small batches of injectable dosage forms via a sterile fill-finish process, for clinical trials.

The rise of the sterile injectable drug market

The global injectable drug market is anticipated to augment at a growth rate of 8.67% through 2027, reaching $39.831 billion by the end of the year [1].

More specifically, the sterile injectable drug business is expected to see a growth rate of about 10.5% from 2018 to 2023 [2].

The increasing development of biologics, antibody-drug conjugates, and monoclonal antibodies has ignited the growing demand for sterile injectable drug manufacturing.

Furthermore, due to the increasing need for parenteral administration systems, prefilled syringes are playing an important role in the aseptic injectable medicine market as well.

Other factors fueling the growth of CDMO service requirement for sterile injectables include a focus on the development of biotech-engineered oncology compounds and the trend by biopharma to externalize development, manufacturing, and testing activities.

Thus, as the sterile injectable drug market grows more and more, the need to produce this kind of medicinal products in small batches for early phase clinical trials has become a common pressing need for emerging startups in the biotechnology space.

Why is the need for small-batch manufacturing growing?

Non-EU biotech companies may have a hard time to find a small to mid-sized drug product manufacturer in Europe with the necessary flexibility to fabricate small batches of vials (e.g. 2,500-4,000 units), particularly for use in phase 1 or 2 clinical trials.

The rise of biologics, orphan drugs, and precision medicine is modifying the paradigm for CDMOs, which are being requested to produce batches of smaller size.

In 2017 the FDA announced its intention to speed up reviews of drugs that are requesting orphan drug designation.

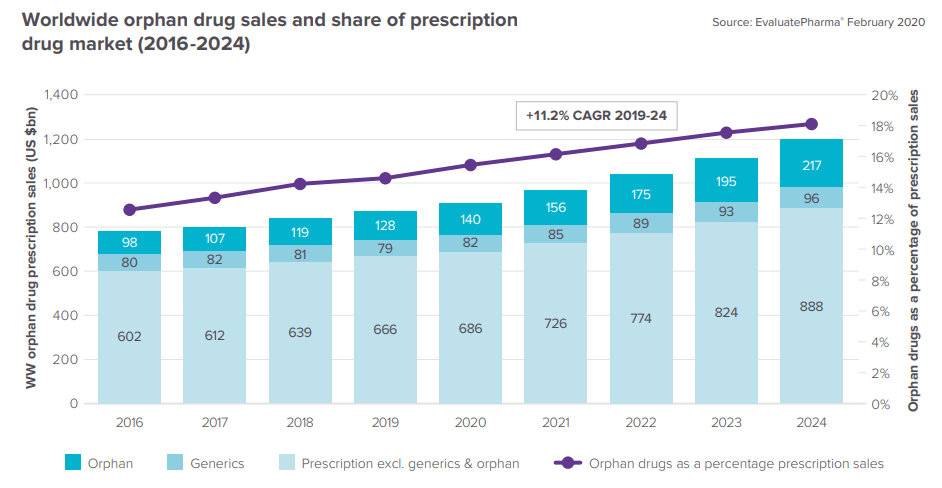

The Orphan Drug Report 2020 of EvaluatePharma provides remarkable data on worldwide orphan drug sales and share of prescription drug market between 2016 and 2024.

According to the EvaluatePharma report:

“After nearly four decades of relatively consistent growth, orphan drugs now comprise a cornerstone of the pharmaceutical market, with this category predicted to rake in $217bn in 2024. That is over 18% of overall prescription sales in 2024. Remarkably, the market is so robust that rare diseases now take home a large portion of FDA drug approvals. In 2019, just under half (44%) of new FDA approvals went to orphan drugs. And the value created by orphan R&D drugs, based on consensus forecasts, is 20 percentage points higher than non-orphan drugs.”

Then, the boom of the orphan drug market and the trend towards more targeted therapies for selected patient populations is creating the necessity of making smaller batches of more complex drugs.

However, faced with this increasing demand, many CDMOs are encountering difficulties when it comes to making pioneering medicines in small quantities.

What are the challenges of small-batch manufacturing?

In general, producing drugs in small batches implies technical issues for CDMOs, as well as losses in terms of efficiency and revenue.

Traditionally, drug manufacturers have used large sterile injectable fill-finish machines able to produce substantial amounts of drug products with high efficiency and profitability.

But emerging biotechnology companies often require small production runs of more complex products, with a variety of containers, and other client-specific requirements.

And, of course, they also need the drug product to be made fast.

The problem is that high-volume production plants and machinery are big and rigid, and these infrastructures and technologies cannot be easily reconfigured to manufacture reduced amounts of vials with profitable efficiency.

Large production lines cannot afford the extended downtimes needed to prepare the assembly of a tiny, highly-specific fill and finish process.

Usually, big CDMOs have systems and standard operating procedures designed for large-scale manufacturing of commercial products, so they may lack the flexibility to serve small orders with very particular specifications.

Consequently, from a business standpoint, large CDMOs will tend to prioritize large-batch orders from big pharma customers, to the detriment of small biotech.

Then, small biotechs may have their compounds marginalized in the production queue, so they will need to look for other more flexible CDMOs able to meet their requirements.

Smaller CDMOs with the capabilities to assume these small and sophisticated projects become a valued option.

The point is that the ideal CDMO for these types of projects not only has to be able to produce small batches, it also needs to be competent regarding the particular technology required for sterile processing.

What are the challenges of aseptic drug manufacturing?

Aseptic manufacturing and sterile fill-finish is a process in which the drug product, container, and closure elements are sterilized, separately, and then assembled together. In this process, containers must be filled and closed in highly controlled rigorous conditions (sterile fill-finish).

Sterile manufacturing is a costly and challenging task because it requires specialized staff, start-of-the-art technology, and dedicated facilities.

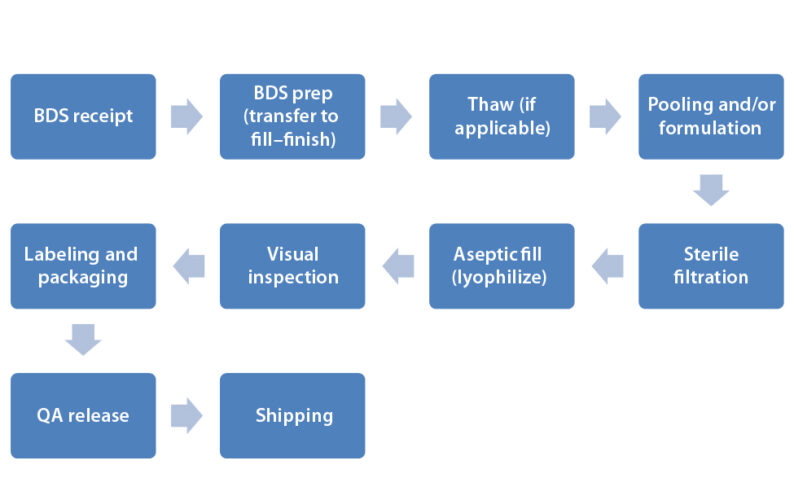

The figure below shows the steps and procedures typically involved in aseptic biologic drug product manufacturing, starting from the bulk drug substance (BDS).

Steps in sterile biologic drug product manufacturing (image from “Critical Factors for Fill–Finish Manufacturing of Biologics” by Don Paul Kovarcik) [3]

Aseptic handling seeks to avoid any source of contamination derived from drug elements, containers, equipment, facilities, and operators.

All these requirements are not met by all CDMOs, which makes the search for the right manufacturer a bit more complicated.

Conclusion

The need for small-batch manufacturing and sterile fill-finish operations —commonly required by emerging biotechs— will continue to grow as more novel and complex drug products are developed.

Not so many CDMOs have the availability, flexibility, know-how, or means to manufacture small volumes of sterile injectables for early phase clinical trials. This is also the case in Europe.

Therefore, finding the right European CDMO to produce aseptic injectable drugs in reduced amounts is not so straightforward.

We want to help biotech firms in their search, so here you can download a list of highly recommended European CDMOs for small-batch aseptic manufacturing of injectable drugs, with full contact information.

You can send us an email to info@sofpromed.com if you need to find a suitable CDMO in Europe.

References:

[1] Injectable drug delivery market to register USD 39.8 billion by 2027

[3] Image taken from the article “Critical Factors for Fill–Finish Manufacturing of Biologics.”